Hyperconnected customers demanding personalised services are calling for an acceleration of their banks’ digital transformation. More specifically, they are calling on their banks to speed up their transition toward more security and advice, as well as digital and environmentally responsible products and services. Although well aware of these new challenges, banks are showing a decline in digital maturity compared to 2021, with many if not most of them reviewing their priorities in 2022.

These are some of the main conclusions that can be drawn from the results of this year’s Digital Banking Experience (DBX) report. Those results were revealed by Sopra Steria at the 2022 Sopra Banking Summit, a week-long annual festival of fintech, which took place last October.

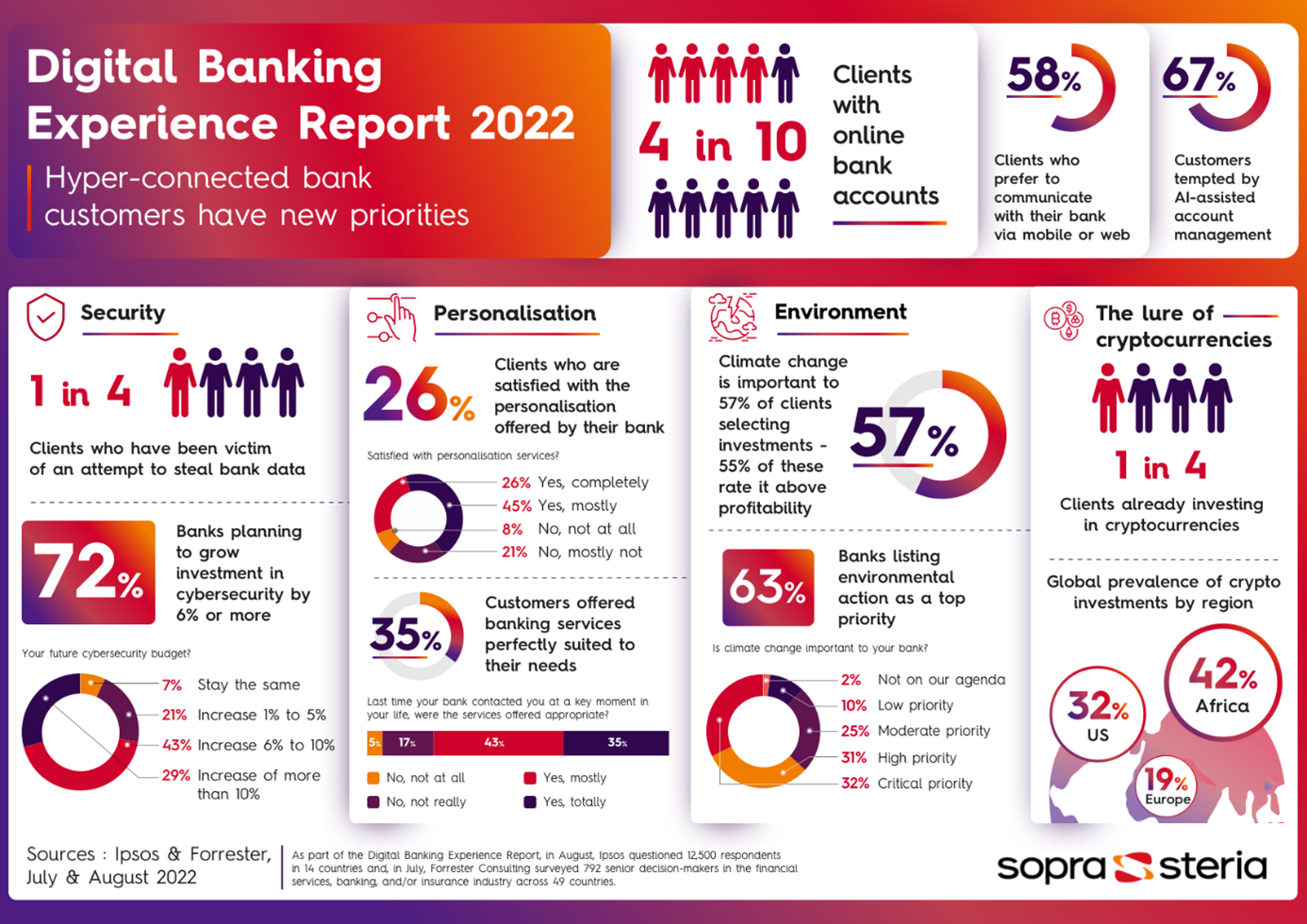

For the second year in a row, the Digital Banking Experience report assesses the digital maturity of today’s banks and their ability to keep pace with their customers' latest expectations. The research is based on a cross-analysis of banks' perceptions (792 banking sector decision-makers surveyed by Forrester in 50 countries) and consumers' perceptions (12,500 customers surveyed by Ipsos in 14 countries).

Customers’ views

Let’s have a quick look at the consumers’ perceptions first. An analysis of their views suggests that there is a gap to be bridged between the priorities set by banks and the expectations of their customers, which are changing at a rapid pace.

Despite the apparent proximity and ease of communicating with their bank through digital channels, customers note the banks’ lack of presence at key moments in their lives when they are looking for advice, support, and personalised services. Only 26% of customers say they are completely satisfied with the level of personalisation offered by digital tools, and 29% are dissatisfied with the banks’ ability to listen to them on these same channels.

The discrepancies between what customers want and the services actually offered are leading customers to question whether the relationship with their bank is really long-lasting. This no doubt explains the fact that almost half of the customers (46%) say they would open an account with a non-banking player if it offered appealing products. In Europe, this figure is highest in Luxembourg (51%), but only amounts to one in ten customers (11%) in the Netherlands.

From hyperconnectivity to hyperpersonalisation

Today’s customers are hyperconnected, familiar with digital journeys, have multiple banks, and interact less often with their bank adviser. Nearly four out of ten customers (39%) now have an online bank, which 36% consult with at least once a day. Mobile applications and websites are the primary channels of communication for six out of ten respondents (58%). Only 25% of customers report that they contact their adviser as a first choice, although in France 57% of customers claim to do so, compared to 23% in the Netherlands.

For the most sophisticated users, digital is no longer just a channel for interaction. It is also expected to be a high-value-added payment and management channel. Management assistance services supported by artificial intelligence are of great interest to 67% of respondents, who would willingly use a personalised recommendation and alert system in case of financial problems. Meanwhile, 68% of customers are interested in an application that would gather all their payment methods. The appeal of cryptocurrencies is also growing, with one in four clients invested in cryptocurrencies, a trend that is particularly prevalent in Africa (42%) and the US (32%).

Security: a driver of value as well as a requirement

As a result of the increased use of digital tools, cybersecurity is a growing concern shared by both banks and their customers. More than one in four customers have suffered an attempt to hack into their bank account or to steal their identity, and more than one in seven of these attempts have been successful. However, 82% of cyberattack victims believe that digital technology has helped make exchanges and transactions with their bank more secure.

Although banks continue to enjoy a high level of trust, they are expected to be more proactive in their responses. More than two-thirds of banks (72%) say they plan to increase investment by more than 6% to better integrate cybersecurity into their strategic plans. Furthermore, one in four customers would be willing to sign up for a banking service that better guarantees the security of their data.

The environment: a new criterion for choice

Nearly one in four customers indicate that fighting global warming is a key issue, and 55% of them even say that this is becoming more important than investment profitability. For their part, bank managers recognise the role they have to play and are integrating environmental issues into their strategy. They see this as a source of differentiation and an opportunity to build customer trust and reduce their environmental impact. Furthermore, 63% of banks say that the environment is a priority on their agenda.

The key lesson to take away from these consumers’ perceptions, is that banks need to accelerate their digital transformation in order to meet their customers' expectations for new services. Technology and data analysis are key levers that banks can activate to differentiate themselves while ensuring control of the regulatory framework. In all of these domains, from technology to legislation, our expert teams can assist and support you, drawing from over 40 years of experience in the banking industry.

The key lesson to take away from these consumers’ perceptions, is that banks need to accelerate their digital transformation in order to meet their customers' expectations for new services. Technology and data analysis are key levers that banks can activate to differentiate themselves while ensuring control of the regulatory framework. In all of these domains, from technology to legislation, our expert teams can assist and support you, drawing from over 40 years of experience in the banking industry.

In my next blog post, I will take a closer look at the perceptions and priorities of the banks that participated in the 2022 edition of our Digital Banking Experience report.